SIMPLIFY

Vendor Credentialing & Maintenance Operations

It’s time to stop talking and start improving your process for vendor compliance and property maintenance – and we’ll be here with you from the first conversation to full user adoption and ongoing support.

SIMPLIFY

Vendor Credentialing & Maintenance Operations

It’s time to stop talking and start improving your process for vendor compliance and property maintenance – and we’ll be here with you from the first conversation to full user adoption and ongoing support.

How Can We Help?

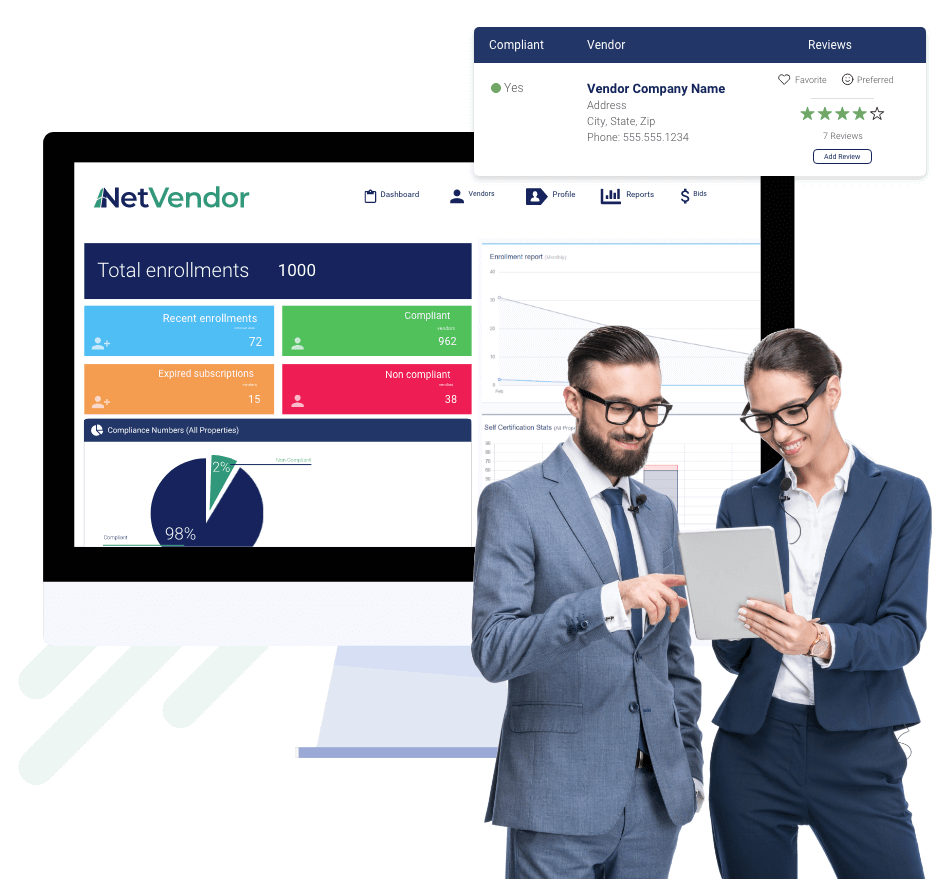

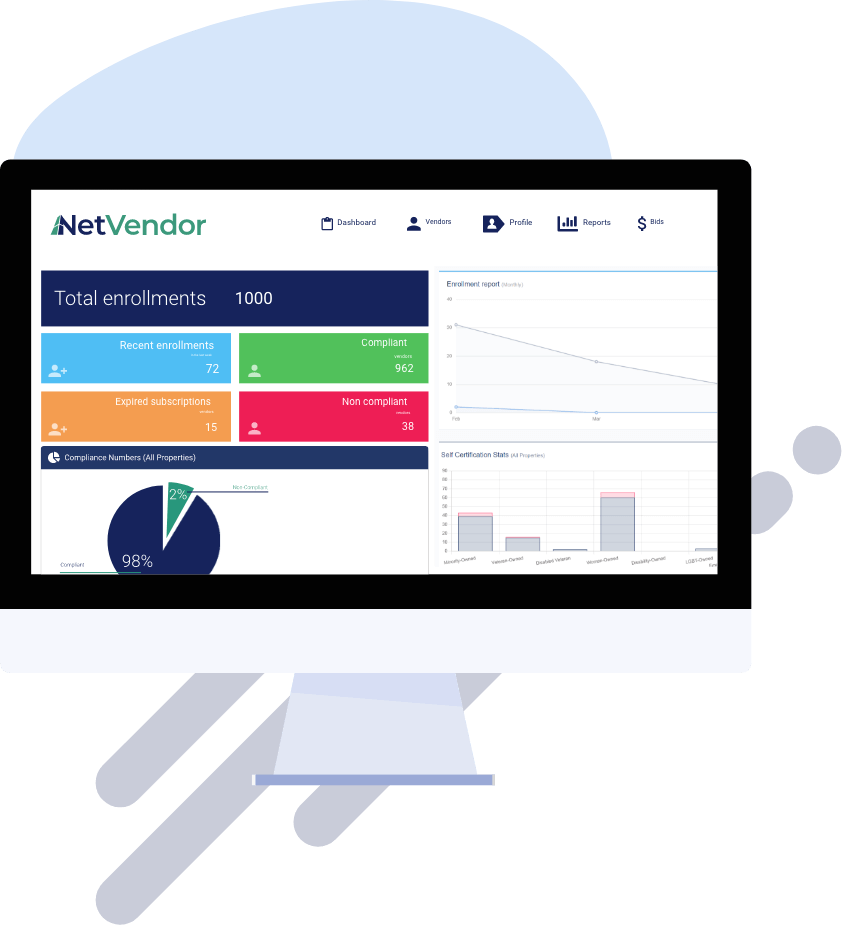

Built exclusively for real estate, our in-house NetVendor licensed agents manage your vendor credentialing by ensuring COI compliance and taking care of your vendor risk management.

(Formerly ServusConnect)

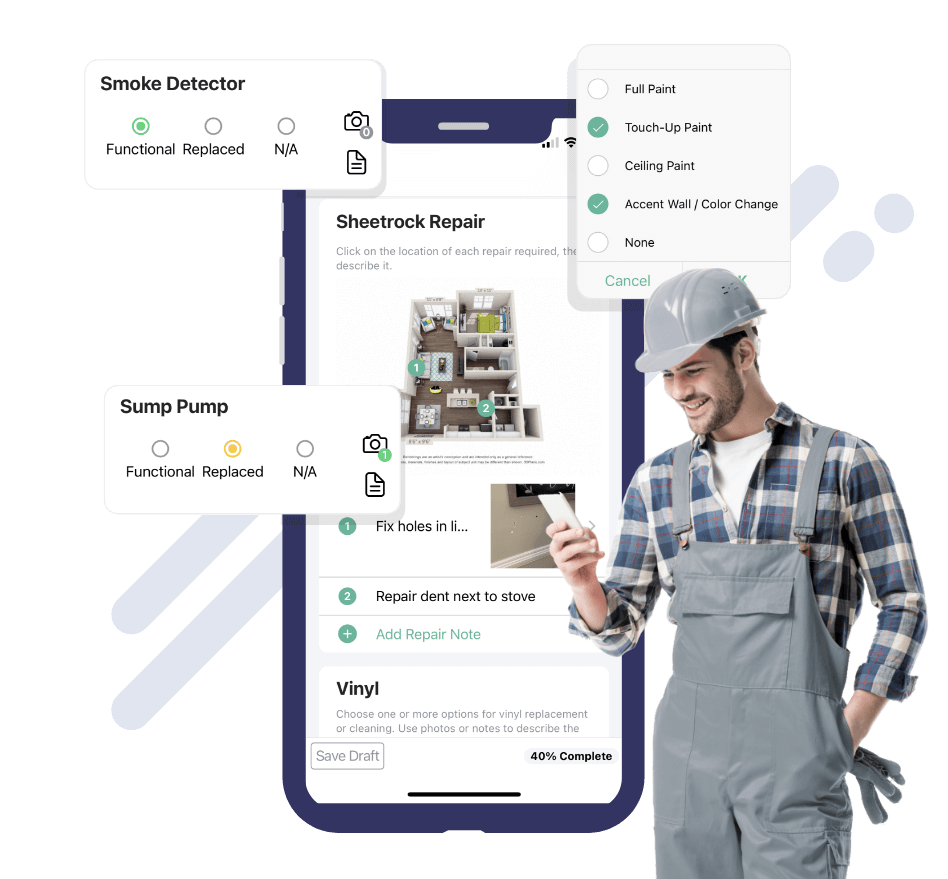

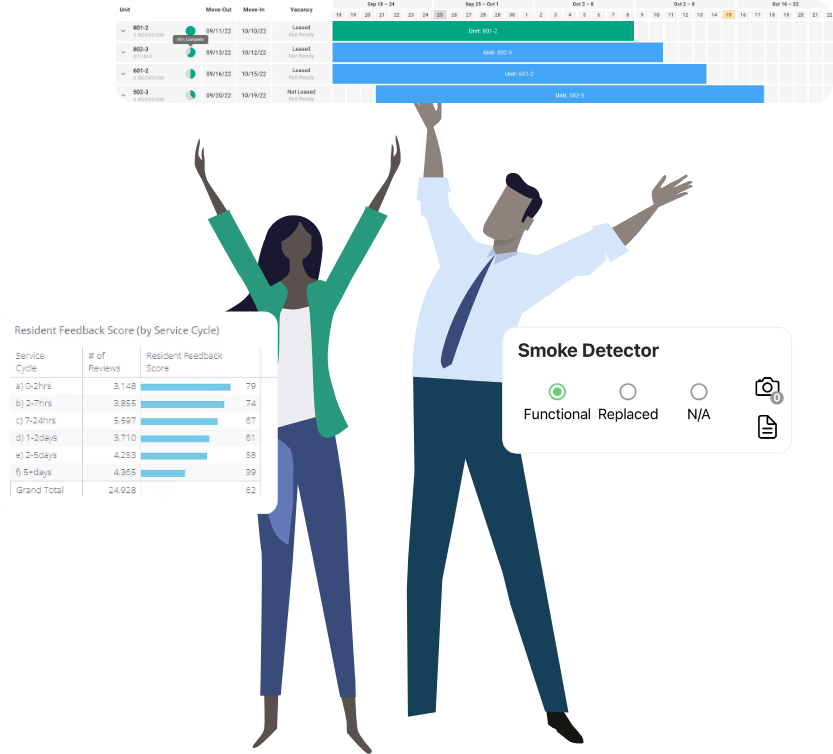

NetVendor Maintenance helps you simplify property management by taking your maintenance operations to the next level with features like mobile maintenance, digital inspections & resident notifications.

Who We Serve

Property Management Companies

We help you create standardized, digital workflows for everything from work orders and inspections to vendor registration and vendor risk management.

Vendors & Maintenance Technicians

Easily monitor your vendor network, no matter how large or dispersed, and for vendors, we show you how to become a vendor for property management companies.

Multifamily Maintenance Teams

Resident engagement is a pillar in our platform. Happy residents are loyal residents and loyal residents renew.

Complete Vendor Management

Finding, vetting and managing third-party vendors is difficult for PMCs, with chasing paperwork and manually tracking vendors.

Built exclusively for real estate, NetVendor Compliance takes care of everything. Our team of licensed agents manages your PMC vendor networks, reduce vendor-related risk, and save hours of tedious tracking.

Digitize Property Maintenance

Simple to use and integrated directly with your PMS, NetVendor Maintenance (ServusConnect) takes your maintenance operations to the next level with features like mobile maintenance, resident notifications & surveys, tailored inspections, and meaningful data & reporting through our amazing BI & Analytics platform.

LET'S CONNECT!

It’s easy to get started.

Schedule a quick 30 minute demo with our team to learn more about our services!

Get started in minutes with NetVendor Compliance’s easy-to-use vendor compliance service. Schedule a demo today!

Looking to digitize your property maintenance? Schedule a demo with NetVendor Maintenance to learn how!